Multiple Choice

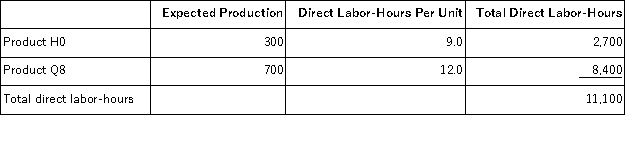

Kamerling, Inc., manufactures and sells two products: Product H0 and Product Q8. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $16.50 per DLH. The direct materials cost per unit for each product is given below:

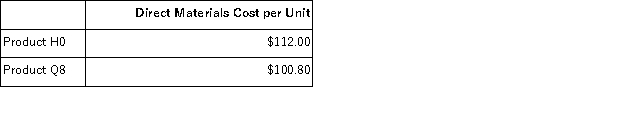

The direct labor rate is $16.50 per DLH. The direct materials cost per unit for each product is given below:  The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

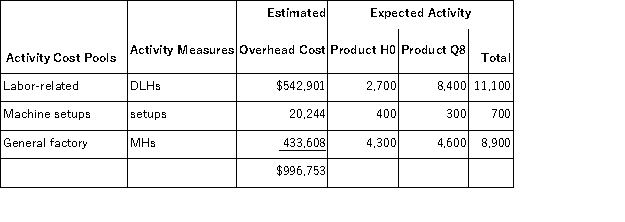

The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  The overhead applied to each unit of Product Q8 under activity-based costing is closest to:

The overhead applied to each unit of Product Q8 under activity-based costing is closest to:

A) $1,077.60 per unit

B) $320.16 per unit

C) $919.47 per unit

D) $996.75 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q100: Sampaga, Inc., manufactures and sells two products:

Q101: Jaure, Inc., manufactures and sells two products:

Q102: Direct labor is an appropriate allocation base

Q103: Brenneis, Inc., manufactures and sells two products:

Q104: Swimm Company allocates materials handling cost to

Q106: Schoeninger, Inc., manufactures and sells two products:

Q107: Parody, Inc., manufactures and sells two products:

Q108: Hewett, Inc., manufactures and sells two products:

Q109: Klasinski, Inc., manufactures and sells two products:

Q110: When a company changes from a traditional