Essay

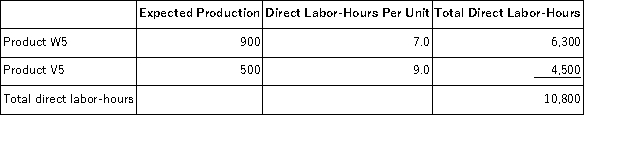

Parody, Inc., manufactures and sells two products: Product W5 and Product V5. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $16.30 per DLH. The direct materials cost per unit for each product is given below:

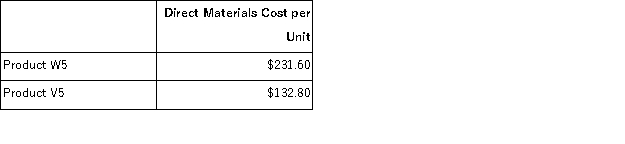

The direct labor rate is $16.30 per DLH. The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

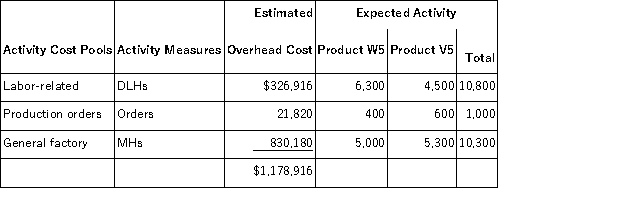

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

Required:

In all computations involving dollars in the following requirements, round off your answer to the nearest whole cent.

a. The company currently uses a traditional costing method in which overhead is applied to products based solely on direct labor-hours. Compute the company's predetermined overhead rate under this costing method.

b. How much overhead would be applied to each product under the company's traditional costing method?

c. Determine the unit product cost of each product under the company's traditional costing method.

d. Compute the activity rates under the activity-based costing system.

e. Determine how much overhead would be assigned to each product under the activity-based costing system.

f. Determine the unit product cost of each product under the activity-based costing method.

Correct Answer:

Verified

a. Predetermined overhead rate = Estimat...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: Direct labor is an appropriate allocation base

Q103: Brenneis, Inc., manufactures and sells two products:

Q104: Swimm Company allocates materials handling cost to

Q105: Kamerling, Inc., manufactures and sells two products:

Q106: Schoeninger, Inc., manufactures and sells two products:

Q108: Hewett, Inc., manufactures and sells two products:

Q109: Klasinski, Inc., manufactures and sells two products:

Q110: When a company changes from a traditional

Q111: Filosa, Inc., manufactures and sells two products:

Q112: Kuperman, Inc., manufactures and sells two products: