Essay

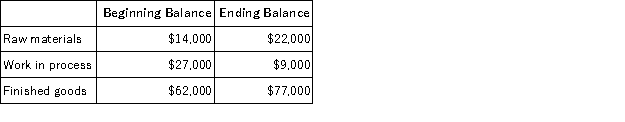

Bakerston Company is a manufacturing firm that uses job-order costing. The company's inventory balances were as follows at the beginning and end of the year:  The company applies overhead to jobs using a predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that it would work 33,000 machine-hours and incur $231,000 in manufacturing overhead cost. The following transactions were recorded for the year:

The company applies overhead to jobs using a predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that it would work 33,000 machine-hours and incur $231,000 in manufacturing overhead cost. The following transactions were recorded for the year:

• Raw materials were purchased, $315,000.

• Raw materials were requisitioned for use in production, $307,000 ($281,000 direct and $26,000 indirect).

• The following employee costs were incurred: direct labor, $377,000; indirect labor, $96,000; and administrative salaries, $172,000.

• Selling costs, $147,000.

• Factory utility costs, $10,000.

• Depreciation for the year was $127,000 of which $120,000 is related to factory operations and $7,000 is related to selling, general, and administrative activities.

• Manufacturing overhead was applied to jobs. The actual level of activity for the year was 34,000 machine-hours.

• Sales for the year totaled $1,253,000.

Required:

a. Prepare a schedule of cost of goods manufactured.

b. Was the overhead underapplied or overapplied? By how much?

c. Prepare an income statement for the year. The company closes any underapplied or overapplied overhead to Cost of Goods Sold.

Correct Answer:

Verified

a. Schedule of cost of goods m...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: Stelmack Corporation, a manufacturing Corporation, has provided

Q52: Cribb Corporation uses direct labor-hours in its

Q61: On August 1, Shead Corporation had $35,000

Q64: On March 1, Metevier Corporation had $37,000

Q65: Meyers Corporation had the following inventory balances

Q68: Meyers Corporation had the following inventory balances

Q69: The Commonwealth Company uses a job-order costing

Q71: Killian Corporation began operations on January 1.

Q112: Departmental overhead rates are generally preferred to

Q133: Epolito Corporation incurred $87,000 of actual Manufacturing