Essay

The Commonwealth Company uses a job-order costing system and applies manufacturing overhead cost to jobs using a predetermined overhead rate based on the cost of materials used in production. At the beginning of the year, the following estimates were made as a basis for computing the predetermined overhead rate: manufacturing overhead cost, $186,000; direct materials cost, $155,000. The following transactions took place during the year (all purchases and services were acquired on account):

a. Raw materials purchased, $96,000.

b. Raw materials requisitioned for use in production (all direct materials), $88,000.

c. Utility bills incurred in the factory, $17,000.

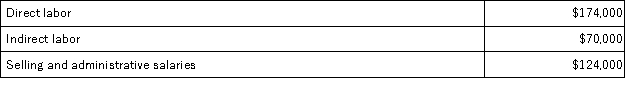

d. Costs for salaries and wages incurred as follows:  e. Maintenance costs incurred in the factory, $12,000.

e. Maintenance costs incurred in the factory, $12,000.

f. Advertising costs incurred, $98,000.

g. Depreciation recorded for the year, $75,000 (75 percent relates to factory assets and the remainder relates to selling, general, and administrative assets).

h. Rental cost incurred on buildings, $80,000 (80 percent of the space is occupied by the factory, and 20 percent is occupied by sales and administration).

i. Miscellaneous selling, general, and administrative costs incurred, $12,000.

j. Manufacturing overhead cost was applied to jobs.

k. Cost of goods manufactured for the year, $480,000.

l. Sales for the year (all on account) totaled $900,000. These goods cost $550,000 to manufacture.

Required:

Prepare journal entries to record the information above. Key your entries by the letters a through l.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Hudek Inc., a manufacturing Corporation, has provided

Q52: Cribb Corporation uses direct labor-hours in its

Q64: On March 1, Metevier Corporation had $37,000

Q65: Meyers Corporation had the following inventory balances

Q66: Bakerston Company is a manufacturing firm that

Q68: Meyers Corporation had the following inventory balances

Q71: Killian Corporation began operations on January 1.

Q72: Echo Corporation uses a job-order costing system

Q73: The direct labor rate for Brent Corporation

Q112: Departmental overhead rates are generally preferred to