Essay

Eagle Airways Company is planning a project that is expected to last for six years and generate annual net cash inflows of $75,000. The project will require the purchase of a $280,000 machine, which is expected to have a salvage value of $10,000 at the end of the six-year period. The machine will require a $50,000 overhaul at the end of the fourth year. The company presently has a 12% minimum desired rate of return.

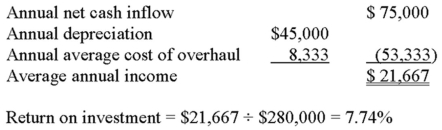

Based on this information, an accountant prepared the following analysis:

The accountant recommends that the project be rejected because it does not meet the company's minimum desired rate of return. Ignore income taxes.

Required:

A. What criticism(s) would you make of the accountant's evaluation?

B. Use the net-present-value method and determine whether the project should be accepted.

C. Based on your answer in requirement "B," is the internal rate of return greater or less than 12%? Explain.

Correct Answer:

Verified

A. The accountant is focusing on income ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: Consider the following statements about the accounting

Q32: The decision process that has managers select

Q44: Which of the following is taken

Q45: Which of the following is the proper

Q47: If income taxes are ignored, which of

Q51: A profitability index can be used to

Q52: Bath Works Company has $70,000 of depreciation

Q74: The systematic follow-up on a capital project

Q82: Consider the following statements about the total-cost

Q110: If a company desires to be in