Multiple Choice

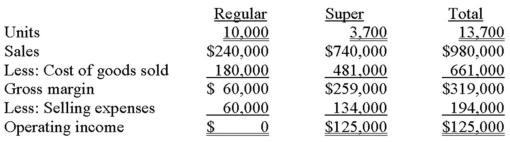

HiTech manufactures two products: Regular and Super. The results of operations for 20x1 follow.  Fixed manufacturing costs included in cost of goods sold amount to $3 per unit for Regular and $20 per unit for Super. Variable selling expenses are $4 per unit for Regular and $20 per unit for Super; remaining selling amounts are fixed.

Fixed manufacturing costs included in cost of goods sold amount to $3 per unit for Regular and $20 per unit for Super. Variable selling expenses are $4 per unit for Regular and $20 per unit for Super; remaining selling amounts are fixed.

HiTech wants to drop the Regular product line. If the line is dropped, company-wide fixed manufacturing costs would fall by 10% because there is no alternative use of the facilities. What would be the impact on operating income if Regular is discontinued?

A) $0.

B) $10,400 increase.

C) $20,000 increase.

D) $39,600 decrease.

E) None of the other answers are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: A trade-off in a decision situation sometimes

Q51: A technique that is useful in exploring

Q59: The Shoe Department at the El

Q60: Coastal Airlines has a significant presence at

Q61: St. Joseph Hospital has been hit with

Q62: Fester Company is considering whether to sell

Q64: Allegiance, Inc. has $125,000 of inventory that

Q66: Ortega Interiors provides design services to residential

Q67: Riverside Company manufactures G and H in

Q68: Stoffers Corporation manufactures products J, K, and