Essay

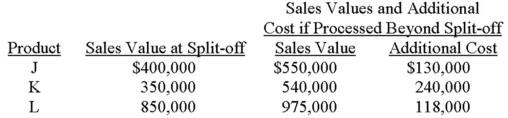

Stoffers Corporation manufactures products J, K, and L in a joint process. The company incurred $480,000 of joint processing costs during the period just ended and had the following data that related to production:

An analysis revealed that all costs incurred after the split-off point are variable and directly traceable to the individual product line.

Required:

A. If Stoffers allocates joint costs on the basis of the products' sales values at the split-off point, what amount of joint cost would be allocated to product J?

B. If production of J totaled 50,000 gallons for the period, determine the relevant cost per gallon that should be used in decisions that explore whether to sell at the split-off point or process further? Briefly explain your answer.

C. At the beginning of the current year, Stoffers decided to process all three products beyond the split-off point. If the company desired to maximize income, did it err in regards to its decision with product J? Product K? Product L? By how much?

Correct Answer:

Verified

A. The total sales value at split-off am...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: A trade-off in a decision situation sometimes

Q21: A factory that makes a part has

Q63: HiTech manufactures two products: Regular and Super.

Q64: Allegiance, Inc. has $125,000 of inventory that

Q66: Ortega Interiors provides design services to residential

Q67: Riverside Company manufactures G and H in

Q69: Laredo manufactures Nuts and Bolts from a

Q71: Summers Corporation is composed of five

Q72: Waltherboro Company recently discontinued the manufacture

Q73: Two months ago, Victory Corporation purchased 4,500