Multiple Choice

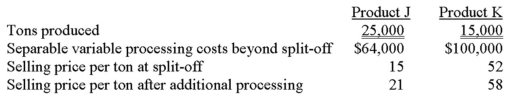

Indiana Corporation has $200,000 of joint processing costs and is studying whether to process J and K beyond the split-off point. Information about J and K follows.  If Indiana desires to maximize total company income, what should the firm do with regard to Products J and K?

If Indiana desires to maximize total company income, what should the firm do with regard to Products J and K?

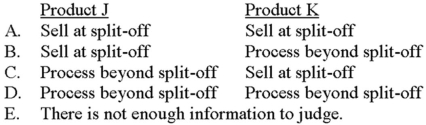

A) Choice A

B) Choice B

C) Choice C

D) Choice D

E) Choice E

Correct Answer:

Verified

Correct Answer:

Verified

Q19: A firm that decides to emphasize those

Q72: Waltherboro Company recently discontinued the manufacture

Q73: Two months ago, Victory Corporation purchased 4,500

Q73: The concept of a relevant cost can

Q74: Occular is studying whether to drop a

Q76: Smythe Manufacturing has 27,000 labor hours available

Q79: Johnstone Company makes two products: Carpet

Q80: Laredo manufactures Nuts and Bolts from a

Q81: Maddox, a division of Stanley Enterprises, currently

Q82: CompuTronics, a manufacturer of computer peripherals,