Essay

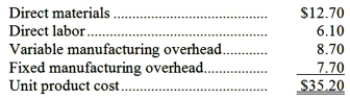

A customer has asked Twiner Corporation to supply 5,000 units of product D05, with some modifications, for $40.20 each. The normal selling price of this product is $52.80 each. The normal unit product cost of product D05 is computed as follows:  Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like some modifications made to product D05 that would increase the variable costs by $3.50 per unit and that would require a one-time investment of $23,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order.

Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like some modifications made to product D05 that would increase the variable costs by $3.50 per unit and that would require a one-time investment of $23,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order.

Required:

Determine the effect on the company's total net operating income of accepting the special order. Show your work!

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Coakley Beet Processors,Inc. ,processes sugar beets in

Q23: Kramer Company makes 4,000 units per year

Q43: The management of Freshwater Corporation is considering

Q63: Sohr Corporation processes sugar beets that it

Q80: The Western Company is considering the

Q103: Mckerchie Inc. manufactures industrial components. One of

Q115: The Varone Company makes a single product

Q127: The Rodgers Company makes 27,000 units of

Q142: Costs which are always relevant in decision

Q153: Ahsan Company makes 60,000 units per year