Essay

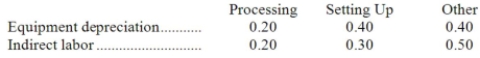

Yentzer Corporation has an activity-based costing system with three activity cost pools-Processing, Setting Up, and Other. The company's overhead costs consist of equipment depreciation and indirect labor and are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Equipment depreciation totals $72,000 and indirect labor totals $8,000. Data concerning the distribution of resource consumption across activity cost pools appear below:  Required:

Required:

Assign overhead costs to activity cost pools using activity-based costing.

Correct Answer:

Verified

Assign overhead costs to activity cost p...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Designing a new product is an example

Q8: Would the following activities at a manufacturer

Q10: Hugle Corporation's activity-based costing system has three

Q36: Roshannon Corporation uses activity-based costing to compute

Q49: Bevard Nuptial Bakery makes very elaborate

Q86: Organization-sustaining activities are activities of the general

Q103: Sibble Corporation uses activity-based costing to assign

Q120: Groch Corporation uses activity-based costing to compute

Q121: Loffredo Corporation has provided the following data

Q131: Abraham Company uses activity-based costing. The company