Multiple Choice

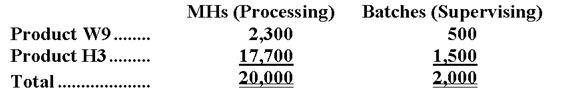

Sibble Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $12,400; Supervising, $4,400; and Other, $5,200. Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

-What is the overhead cost assigned to Product H3 under activity-based costing?

A) $10,974

B) $11,000

C) $3,300

D) $14,274

Correct Answer:

Verified

Correct Answer:

Verified

Q98: Ormond Corporation uses activity-based costing to assign

Q99: The practice of assigning the costs of

Q100: The following data have been provided

Q101: Even departmental overhead rates will not correctly

Q102: Would the following activities at a manufacturer

Q104: Andujo Company allocates materials handling cost to

Q105: Laningham Corporation uses an activity based costing

Q106: Yentzer Corporation has an activity-based costing system

Q107: Pressler Corporation's activity-based costing system has three

Q108: Kozloff Wedding Fantasy Company makes very elaborate