Essay

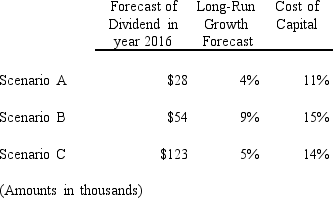

For each of the following scenarios determine the value as of the beginning of 2012 of the continuing dividend:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: One rationale for using expected dividends in

Q10: Equity valuation models based on dividends,cash flows,and

Q12: Zonk Corp.<br>The following data pertains to

Q15: Zonk Corp.<br>The following data pertains to

Q17: Identify the types of firm-specific factors that

Q24: Firm-specific factors that increase the firm's nondiversifiable

Q27: Suppose a firm has a market beta

Q31: The dividends valuation approach measures value-relevant dividends

Q42: Which of the following is not a

Q45: One criticism in using the CAPM to