Multiple Choice

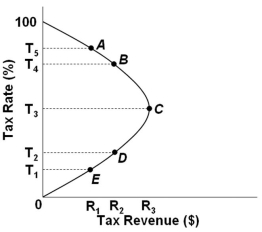

Refer to the Laffer Curve above. A cut in the tax rate from T2 to T1 would:

Refer to the Laffer Curve above. A cut in the tax rate from T2 to T1 would:

A) Decrease tax revenues and support the views of supply-side economists

B) Increase tax revenues and support the views of supply-side economists

C) Increase tax revenues and support the views of mainstream economists

D) Decrease tax revenues and support the views of mainstream economists

Correct Answer:

Verified

Correct Answer:

Verified

Q23: The policy implication of the long-run Phillips

Q87: In the graphs below, Q<sub>P</sub> refers to

Q88: Which is a basic proposition of supply-side

Q89: In the graphs below, Q<sub>P</sub> refers to

Q93: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4895/.jpg" alt=" Refer to the

Q94: The traditional Phillips Curve shows the:<br>A) Direct

Q96: The short-run Phillips Curve intersects the long-run

Q97: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4895/.jpg" alt=" Refer to the

Q114: Demand-pull inflation and cost-push inflation have similar

Q233: The Laffer Curve suggests that within a