Multiple Choice

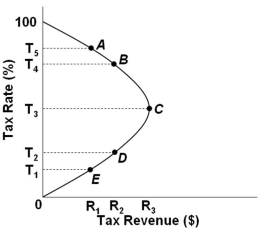

Refer to the Laffer Curve above. An increase in the tax rate from T3 to T4 would:

Refer to the Laffer Curve above. An increase in the tax rate from T3 to T4 would:

A) Decrease tax revenues and support the views of supply-side economists

B) Increase tax revenues and support the views of supply-side economists

C) Increase tax revenues and support the views of mainstream economists

D) Decrease tax revenues and support the views of mainstream economists

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Given a Phillips Curve with stable and

Q6: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4895/.jpg" alt=" Refer to the

Q7: Economist Arthur Laffer argued that Robin Hood

Q8: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4895/.jpg" alt=" Refer to the

Q9: In the long run, if the price

Q10: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4895/.jpg" alt=" Refer to the

Q11: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4895/.jpg" alt=" Refer to the

Q51: The implication of the long-run Phillips Curve

Q153: In the short run, demand-pull inflation will

Q158: The long-run Phillips Curve is essentially a