Multiple Choice

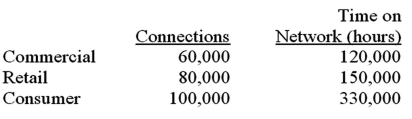

Fenway Telcom has three divisions,commercial,retail,and consumer,that share the common costs of the company's computer server network.The annual common costs are $2,400,000.You have been provided with the following information for the upcoming year:  The cost accountant determined $1,700,000 of the server network's costs were fixed and should be allocated based on the number of connections.The remaining costs should be allocated based on the time on the network.What is the total server network costs allocated to the Commercial Division,assuming the company uses dual-rates to allocate common costs?

The cost accountant determined $1,700,000 of the server network's costs were fixed and should be allocated based on the number of connections.The remaining costs should be allocated based on the time on the network.What is the total server network costs allocated to the Commercial Division,assuming the company uses dual-rates to allocate common costs?

A) $514,286.

B) $480,000.

C) $600,000.

D) $565,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: The Document Creation Center (DCC)for Alegis Corp.provides

Q4: Fenway Telcom has three divisions,commercial,retail,and consumer,that share

Q5: Assets invested in a responsibility center are

Q10: The Copy Department in the College of

Q11: The Document Creation Center (DCC)for Alegis Corp.provides

Q21: The use of dual rates in a

Q44: Which of the following is not a

Q48: Cost allocations based on dual rates assume

Q91: In general,organizations are more centralized in the

Q144: Which of the following is considered a