Multiple Choice

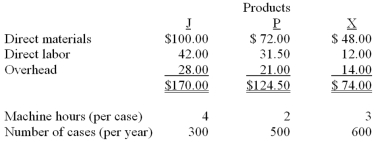

Smelly Perfume Company manufactures and distributes several different products.The company currently uses a plantwide allocation method for allocating overhead at a rate of $7 per direct labor hour.Cindy is the department manager of Department C which produces Products J and P.Department C has $16,200 in traceable overhead.Diane is the department manager of Department D which manufactures Product X.Department D has $11,100 in traceable overhead.The product costs (per case of 24 bottles) and other information are as follows:  If Smelly changes its allocation basis to machine hours,what is the total product cost per case for Product J?

If Smelly changes its allocation basis to machine hours,what is the total product cost per case for Product J?

A) $161.50.

B) $169.30.

C) $182.44.

D) $183.36.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: The single-stage cost allocation system uses a

Q9: Smelly Perfume Company manufactures and distributes several

Q10: Volume-based costing allocates indirect product costs based

Q11: A company has identified the following overhead

Q14: Which of the following measures is used

Q16: Management estimates that it costs $500 to

Q17: Smelly Perfume Company manufactures and distributes several

Q18: Smelly Perfume Company manufactures and distributes several

Q117: Activity-based costing (ABC)can be applied to administrative

Q126: The electricity used for production machinery would