Multiple Choice

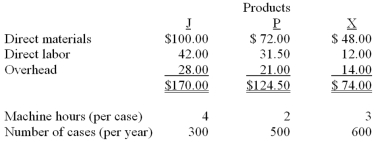

Smelly Perfume Company manufactures and distributes several different products.The company currently uses a plantwide allocation method for allocating overhead at a rate of $7 per direct labor hour.Cindy is the department manager of Department C which produces Products J and P.Department C has $16,200 in traceable overhead.Diane is the department manager of Department D which manufactures Product X.Department D has $11,100 in traceable overhead.The product costs (per case of 24 bottles) and other information are as follows:  Department D has recently purchased and installed new computerized equipment for Product X.This equipment will increase the overhead costs by $2,700 and decrease labor costs (due to time savings) in Department D by $3.00 per case.Machine hours will not change.If Smelly uses departmental rates,what are the product costs per case for Product X assuming Departments C and D use direct labor hours and machine hours as their respective allocation bases?

Department D has recently purchased and installed new computerized equipment for Product X.This equipment will increase the overhead costs by $2,700 and decrease labor costs (due to time savings) in Department D by $3.00 per case.Machine hours will not change.If Smelly uses departmental rates,what are the product costs per case for Product X assuming Departments C and D use direct labor hours and machine hours as their respective allocation bases?

A) $80.00.

B) $74.00.

C) $69.50.

D) $79.50.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: A company has identified the following overhead

Q5: Terri Martin,CPA provides bookkeeping and tax services

Q6: Management estimates that it costs $500 to

Q7: Scottso Enterprises has identified the following overhead

Q10: Volume-based costing allocates indirect product costs based

Q11: A company has identified the following overhead

Q13: Smelly Perfume Company manufactures and distributes several

Q14: Which of the following measures is used

Q117: Activity-based costing (ABC)can be applied to administrative

Q126: The electricity used for production machinery would