Multiple Choice

-Which of the following are considered ad valorem taxes?

A) taxes assessed by charging a rate equal to a percentage of an item's price

B) taxes assessed by charging a flat amount per unit purchased

C) taxes based on the amount of debt that the government must repay

D) taxes based on the amount of spending the government will undertake

Correct Answer:

Verified

Correct Answer:

Verified

Q141: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5018/.jpg" alt=" -Jamal earns $160,000

Q142: Assume that Mr. Smith's income increased from

Q143: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5018/.jpg" alt=" -Refer to the

Q144: The average tax rate can be calculated

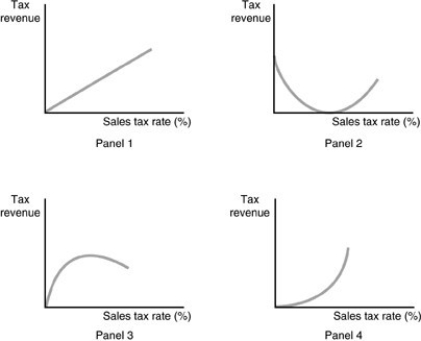

Q145: According to dynamic tax analysis, will continuing

Q147: Suppose the tax amount on the first

Q148: Social Security contributions are<br>A) a voluntary dollar

Q149: Which of the following is TRUE about

Q150: One criticism of the corporate income tax

Q151: Reduction or elimination of dividend taxes is