Multiple Choice

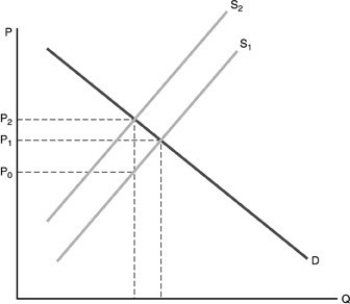

-Refer to the above figure. A unit tax has been placed on the good. The consumer pays what amount of the tax?

A) none of the tax

B) P2 - P0

C) P2 - P1

D) P1 - P0

Correct Answer:

Verified

Correct Answer:

Verified

Q138: Ad valorem taxation means<br>A) that only the

Q139: The tax base is<br>A) the minimum amount

Q140: A tax levied on the purchase of

Q141: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5018/.jpg" alt=" -Jamal earns $160,000

Q142: Assume that Mr. Smith's income increased from

Q144: The average tax rate can be calculated

Q145: According to dynamic tax analysis, will continuing

Q146: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5018/.jpg" alt=" -Which of the

Q147: Suppose the tax amount on the first

Q148: Social Security contributions are<br>A) a voluntary dollar