Multiple Choice

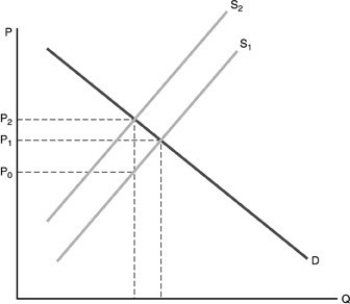

-Refer to the above figure. A unit tax has been placed on the good. The producer pays what amount of the tax?

A) none of the tax

B) P2 - P0

C) P2 - P1

D) P1 - P0

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q10: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5018/.jpg" alt=" -An excise tax

Q11: The distribution of tax burdens among various

Q12: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5018/.jpg" alt=" -Using the above

Q13: A local government currently has a tax

Q14: The largest source of receipts for the

Q16: The sum of public spending on goods

Q17: Social Security taxes are regressive because<br>A) they

Q18: Current concern about Social Security is that<br>A)

Q19: A tax rate system characterized by higher

Q20: What is meant by the term "tax