Multiple Choice

-An excise tax is a tax that is levied on

A) the value of a piece of property.

B) the purchase of a given good or service.

C) the value of an estate.

D) that part of a person's income coming from interest payments.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Which of the following statements is TRUE

Q6: Suppose the income tax rate is 0

Q7: Unit excise taxes imposed on gasoline are<br>A)

Q8: According to the government budget constraint, any

Q9: Local government expenditures depend on which taxes?<br>A)

Q11: The distribution of tax burdens among various

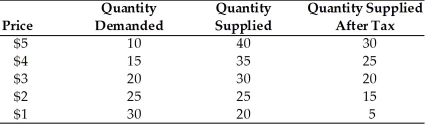

Q12: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5018/.jpg" alt=" -Using the above

Q13: A local government currently has a tax

Q14: The largest source of receipts for the

Q15: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5018/.jpg" alt=" -Refer to the