Multiple Choice

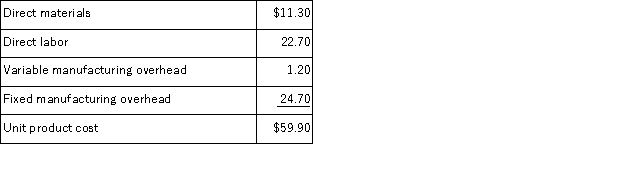

Aholt Corporation makes 40, 000 units per year of a part it uses in the products it manufactures.The unit product cost of this part is computed as follows:  An outside supplier has offered to sell the company all of these parts it needs for $46.20 a unit.If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand.The additional contribution margin on this other product would be $264, 000 per year. If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided.However, $21.90 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier.This fixed manufacturing overhead cost would be applied to the company's remaining products.

An outside supplier has offered to sell the company all of these parts it needs for $46.20 a unit.If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand.The additional contribution margin on this other product would be $264, 000 per year. If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided.However, $21.90 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier.This fixed manufacturing overhead cost would be applied to the company's remaining products.

How much of the unit product cost of $59.90 is relevant in the decision of whether to make or buy the part?

A) $38.00 per unit

B) $59.90 per unit

C) $35.20 per unit

D) $22.70 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q27: Arenz Corporation processes sugar cane in batches.

Q35: Zemlya Corporation currently records $4,000 of depreciation

Q66: Kerbow Corporation uses part B76 in one

Q68: Teich Inc.is considering whether to continue to

Q69: Wehn Refiners Inc. , processes sugar cane

Q70: Consider the following production and cost data

Q73: Wehn Refiners Inc. , processes sugar cane

Q116: Opportunity costs are:<br>A)not used for decision making.<br>B)the

Q127: Opportunity costs are not usually recorded in

Q177: When a company has a production constraint,