Essay

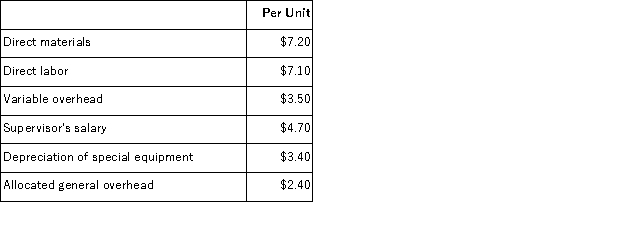

Kerbow Corporation uses part B76 in one of its products.The company's Accounting Department reports the following costs of producing the 12, 000 units of the part that are needed every year.  An outside supplier has offered to make the part and sell it to the company for $27.40 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $6, 000 of these allocated general overhead costs would be avoided.In addition, the space used to produce part B76 could be used to make more of one of the company's other products, generating an additional segment margin of $29, 000 per year for that product.

An outside supplier has offered to make the part and sell it to the company for $27.40 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $6, 000 of these allocated general overhead costs would be avoided.In addition, the space used to produce part B76 could be used to make more of one of the company's other products, generating an additional segment margin of $29, 000 per year for that product.

Required:

a.Prepare a report that shows the effect on the company's total net operating income of buying part B76 from the supplier rather than continuing to make it inside the company.

b.Which alternative should the company choose?

Correct Answer:

Verified

b.The total cost of the make alternativ...

b.The total cost of the make alternativ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: A fixed cost cannot be a differential

Q35: Zemlya Corporation currently records $4,000 of depreciation

Q63: Barrus Corporation makes 30, 000 motors to

Q64: Costabile Corporation is considering dropping product G41O.Data

Q68: Teich Inc.is considering whether to continue to

Q69: Wehn Refiners Inc. , processes sugar cane

Q70: Consider the following production and cost data

Q71: Aholt Corporation makes 40, 000 units per

Q80: Kosakowski Corporation processes sugar beets in batches.

Q105: Bosques Corporation has in stock 35,800 kilograms