Essay

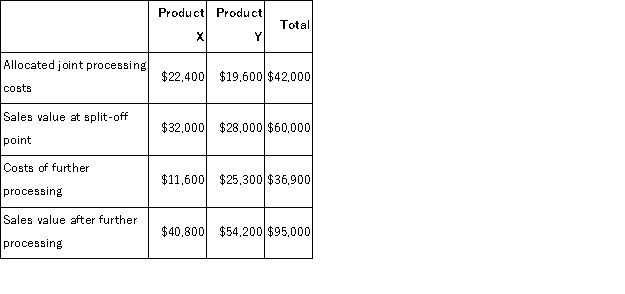

Iaci Company makes two products from a common input.Joint processing costs up to the split-off point total $42, 000 a year.The company allocates these costs to the joint products on the basis of their total sales values at the split-off point.Each product may be sold at the split-off point or processed further.Data concerning these products appear below:  Required:

Required:

a.What is the net monetary advantage (disadvantage)of processing Product X beyond the split-off point?

b.What is the net monetary advantage (disadvantage)of processing Product Y beyond the split-off point?

c.What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?

d.What is the minimum amount the company should accept for Product Y if it is to be sold at the split-off point?

Correct Answer:

Verified

Correct Answer:

Verified

Q44: Management is considering a one-time-only special order.

Q65: A cost that can be avoided by

Q83: Joint costs are relevant in the decision

Q146: One way to increase the effective utilization

Q158: Part S00 is used in one of

Q159: Dockwiller Inc.manufactures industrial components.One of its products,

Q160: The Madison Corporation produces three products with

Q162: Adamyan Co.manufactures and sells medals for winners

Q163: Aholt Corporation makes 40, 000 units per

Q164: Wiacek Corporation has received a request for