Multiple Choice

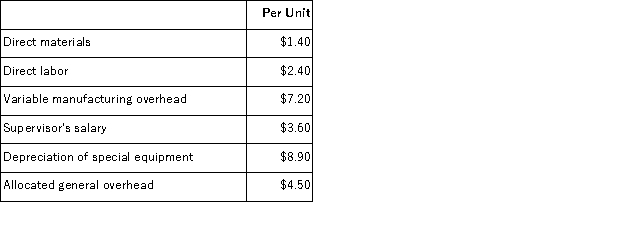

Part S00 is used in one of Morsey Corporation's products.The company makes 6, 000 units of this part each year.The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to produce this part and sell it to the company for $16.10 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $6, 000 of these allocated general overhead costs would be avoided. If management decides to buy part S00 from the outside supplier rather than to continue making the part, what would be the annual impact on the company's overall net operating income?

An outside supplier has offered to produce this part and sell it to the company for $16.10 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $6, 000 of these allocated general overhead costs would be avoided. If management decides to buy part S00 from the outside supplier rather than to continue making the part, what would be the annual impact on the company's overall net operating income?

A) Net operating income would decrease by $3, 000 per year.

B) Net operating income would decrease by $71, 400 per year.

C) Net operating income would decrease by $77, 400 per year.

D) Net operating income would decrease by $65, 400 per year.

Correct Answer:

Verified

Correct Answer:

Verified

Q83: Joint costs are relevant in the decision

Q119: The book value of a machine, as

Q146: One way to increase the effective utilization

Q153: Mitchener Corp.manufactures three products from a common

Q154: The Flint Fan Corporation is considering the

Q159: Dockwiller Inc.manufactures industrial components.One of its products,

Q160: The Madison Corporation produces three products with

Q161: Iaci Company makes two products from a

Q162: Adamyan Co.manufactures and sells medals for winners

Q163: Aholt Corporation makes 40, 000 units per