Essay

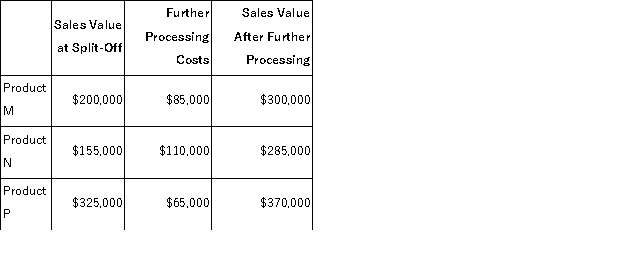

Mitchener Corp.manufactures three products from a common input in a joint processing operation.Joint processing costs up to the split-off point total $300, 000 per year.The company allocates these costs to the joint products on the basis of their total sales value at the split-off point.

Each product may be sold at the split-off point or processed further.The additional processing costs and sales value after further processing for each product (on an annual basis)are:  Required:

Required:

Which product or products should be sold at the split-off point, and which product or products should be processed further? Show computations.

Correct Answer:

Verified

Products M and N should be so...

Products M and N should be so...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: Joint costs are relevant in the decision

Q106: Defective units should be detected and scrapped

Q119: The book value of a machine, as

Q121: Fixed costs may or may not be

Q146: One way to increase the effective utilization

Q149: Jebb's Lettuce Stand currently sells 60, 000

Q152: The constraint at Bonavita Corporation is time

Q154: The Flint Fan Corporation is considering the

Q158: Part S00 is used in one of

Q165: Crooks Corporation processes sugar beets in batches