Multiple Choice

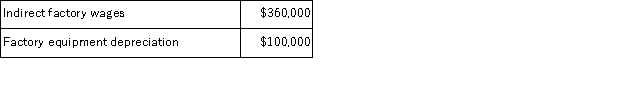

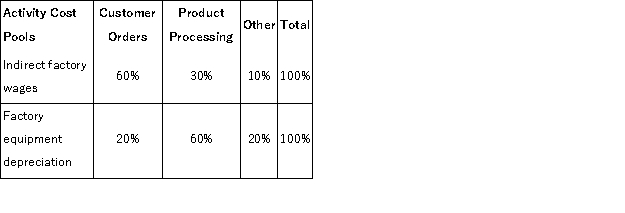

Ort Corporation has provided the following data from its activity-based costing accounting system:  Distribution of Resource Consumption across Activity Cost Pools:

Distribution of Resource Consumption across Activity Cost Pools:  The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products. How much indirect factory wages and factory equipment depreciation cost would NOT be assigned to products using the activity-based costing system?

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products. How much indirect factory wages and factory equipment depreciation cost would NOT be assigned to products using the activity-based costing system?

A) $56, 000

B) $100, 000

C) $360, 000

D) $0

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Moyle Corporation has provided the following data

Q13: Ort Corporation has provided the following data

Q16: Loader Corporation has an activity-based costing system

Q18: Villeda Corporation uses the following activity rates

Q19: Somani Corporation has an activity-based costing system

Q20: Mussenden Corporation has an activity-based costing system

Q21: Andruschack Corporation uses activity-based costing to determine

Q22: Thoen Nuptial Bakery makes very elaborate wedding

Q57: Activity-based costing uses a number of activity

Q69: In traditional costing systems, manufacturing costs that