Essay

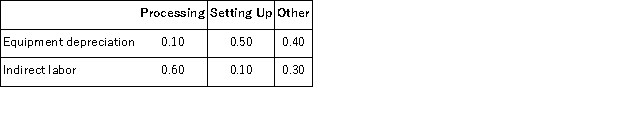

Loader Corporation has an activity-based costing system with three activity cost pools-Processing, Setting Up, and Other.The company's overhead costs consist of equipment depreciation and indirect labor and are allocated to the cost pools in proportion to the activity cost pools' consumption of resources.Equipment depreciation totals $88, 000 and indirect labor totals $1, 000.Data concerning the distribution of resource consumption across activity cost pools appear below:  Required:

Required:

Assign overhead costs to activity cost pools using activity-based costing.

Correct Answer:

Verified

Assign overhead costs to activity cost p...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Mciver Corporation uses activity-based costing to assign

Q12: Moyle Corporation has provided the following data

Q13: Ort Corporation has provided the following data

Q17: Ort Corporation has provided the following data

Q18: Villeda Corporation uses the following activity rates

Q19: Somani Corporation has an activity-based costing system

Q20: Mussenden Corporation has an activity-based costing system

Q21: Andruschack Corporation uses activity-based costing to determine

Q57: Activity-based costing uses a number of activity

Q69: In traditional costing systems, manufacturing costs that