Multiple Choice

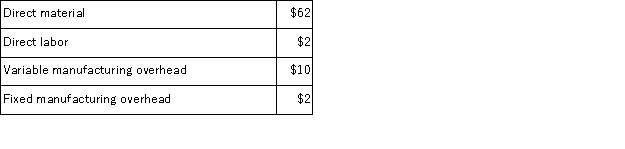

(Appendix 12A) The Western Division of Pryto Corporation sells Part D to other companies for $78.50 per unit.According to the company's cost accounting system, the costs to Western Division to make a unit of Product D are:  The Southern Division of Pryto Corporation uses a part much like Part D in one of its products.The Southern Division can buy this part from an outside supplier for $78.25 per unit.However, the Southern Division could use Part D instead of this part that it purchases from outside suppliers.What is the most that the Southern Division would be willing to pay the Western Division for Product D?

The Southern Division of Pryto Corporation uses a part much like Part D in one of its products.The Southern Division can buy this part from an outside supplier for $78.25 per unit.However, the Southern Division could use Part D instead of this part that it purchases from outside suppliers.What is the most that the Southern Division would be willing to pay the Western Division for Product D?

A) $78.50 per unit

B) $76.00 per unit

C) $74.00 per unit

D) $78.25 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q15: (Appendix 12A)Division 1 of Ace Company makes

Q16: (Appendix 12A)The North Division of Barter Company

Q17: (Appendix 12A)Division A makes watzits.The company has

Q18: (Appendix 12A)A transfer price is the price

Q19: (Appendix 12A)One disadvantage of using the actual

Q20: (Appendix 12A)Division 1 of Ace Company makes

Q21: (Appendix 12A)Setting transfer prices at full cost

Q22: (Appendix 12A)The DVD Division of Sound Company

Q23: (Appendix 12A)In setting a transfer price, which

Q24: (Appendix 12A)The Red River Division of Alto