Multiple Choice

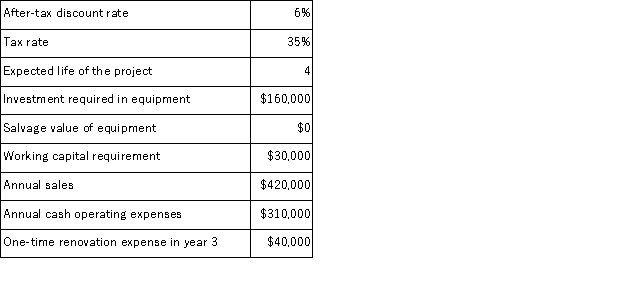

(Appendix 8C) Lucarell Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. The income tax expense in year 3 is:

The company uses straight-line depreciation on all equipment. The income tax expense in year 3 is:

A) $24, 500

B) $14, 000

C) $10, 500

D) $38, 500

Correct Answer:

Verified

Correct Answer:

Verified

Q60: (Appendix 8C)Trammel Corporation is considering a capital

Q61: (Appendix 8C)Folino Corporation is considering a capital

Q62: (Appendix 8C)Brogden Corporation has provided the following

Q63: (Appendix 8C)Under the simplifying assumptions made in

Q64: (Appendix 8C)Gouker Corporation has provided the following

Q66: (Appendix 8C)Pont Corporation has provided the following

Q67: (Appendix 8C)Trammel Corporation is considering a capital

Q68: (Appendix 8C)Shinabery Corporation has provided the following

Q69: (Appendix 8C)Battaglia Corporation is considering a capital

Q70: (Appendix 8C)Pulkkinen Corporation has provided the following