Multiple Choice

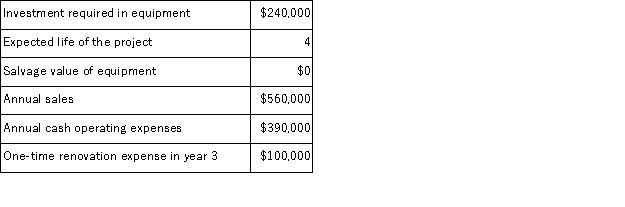

(Appendix 8C) Brogden Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 10%.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The net present value of the entire project is closest to:

The company's income tax rate is 30% and its after-tax discount rate is 10%.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The net present value of the entire project is closest to:

A) $141, 583

B) $223, 630

C) $381, 583

D) $238, 000

Correct Answer:

Verified

Correct Answer:

Verified

Q57: (Appendix 8C)Erling Corporation has provided the following

Q58: (Appendix 8C)Kostka Corporation is considering a capital

Q59: (Appendix 8C)Unless the organization is tax-exempt, income

Q60: (Appendix 8C)Trammel Corporation is considering a capital

Q61: (Appendix 8C)Folino Corporation is considering a capital

Q63: (Appendix 8C)Under the simplifying assumptions made in

Q64: (Appendix 8C)Gouker Corporation has provided the following

Q65: (Appendix 8C)Lucarell Corporation has provided the following

Q66: (Appendix 8C)Pont Corporation has provided the following

Q67: (Appendix 8C)Trammel Corporation is considering a capital