Essay

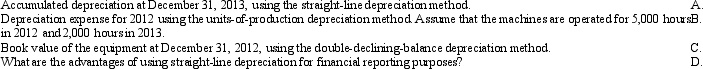

Greeley,Inc.purchased slot machines at the beginning of 2012 for $20,000.The machines have an estimated residual value of $2,000 and an estimated life of 5 years or 20,000 hours of operation.Greeley is looking at alternative depreciation methods for the equipment.Calculate the following:

Correct Answer:

Verified

Correct Answer:

Verified

Q43: Please complete the following sentences:<br> <br>a.Accumulated amortization

Q57: If a company's asset turnover ratio decreased

Q57: Operating assets with no physical properties are

Q58: Captain Lewis,Inc.purchased equipment at the beginning of

Q61: Sheffield Ridge Co.purchased new trucks at the

Q64: Grover,Inc. Grover,Inc.purchased a crane at a cost

Q67: Yu Corporation<br>Use the following Assets section of

Q171: Acquisition cost should not include expenditures unrelated

Q188: A company uses the same depreciation method

Q205: Depreciation is<br>A)an effort to achieve proper matching