Essay

Yu Corporation

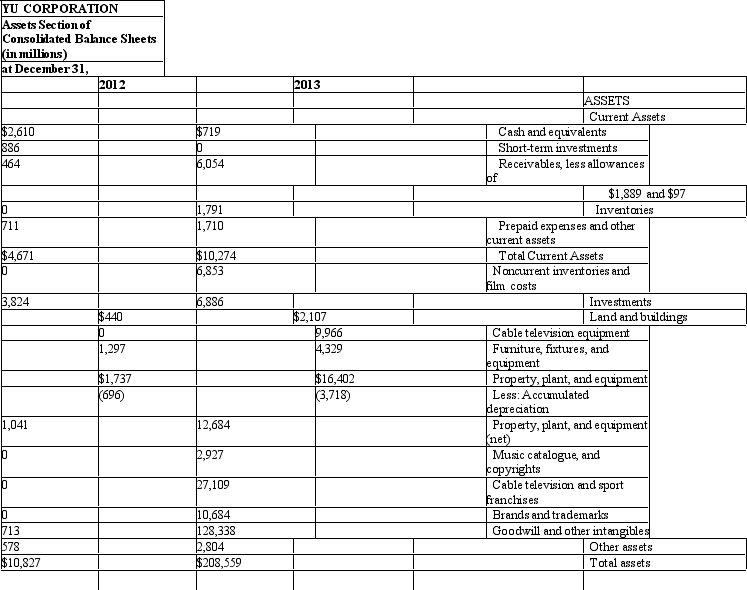

Use the following Assets section of Yu Corporation's balance sheets for the years ended December 31,2013 and 2012 to answer the questions that follow.

Yu Corporation recorded depreciation expense of $344 million for 2012.

Yu Corporation recorded depreciation expense of $344 million for 2012.

Refer to the information for Yu Corporation.

Required:

(1)Explain the impact on net income and cash flows of Yu using straight-line depreciation for financial reporting and accelerated depreciation methods for income tax purposes.

(2)In the notes to the financial statements,Yu indicates that it uses different depreciation methods for different types of plant and equipment assets.Explain why Yu might follow this policy.

Correct Answer:

Verified

(1)Accelerated depreciation allows a com...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q43: Please complete the following sentences:<br> <br>a.Accumulated amortization

Q57: Operating assets with no physical properties are

Q62: Greeley,Inc.purchased slot machines at the beginning of

Q64: Grover,Inc. Grover,Inc.purchased a crane at a cost

Q68: Florence,Inc.purchased equipment at the beginning of 2014

Q140: Darrin Brown bought a pub.The purchase price

Q154: All of the following are included in

Q178: Which of the following factors is not

Q199: All of the following are intangible assets

Q205: Depreciation is<br>A)an effort to achieve proper matching