Essay

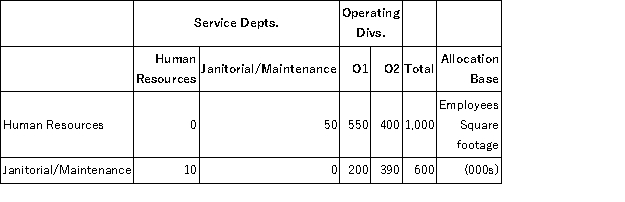

IFLAX manufactures commercial brushes in two operating divisions (O1 and O2) and has two service departments (Human Resources and Janitorial/Maintenance). The two service departments' costs are allocated to the two operating departments. Human Resources' costs of $600,000 are allocated based on the number of employees, and Janitorial/Maintenance costs of $800,000 are allocated based on square footage. The following table summarizes the number of employees and the square footage in each division and department.  Required:

Required:

a. Allocate the costs of the two service departments to the two operating divisions using the direct allocation method.

b. Allocate the costs of the two service departments to the two operating divisions using the step-down allocation method where Human Resources is allocated first and Janitorial/Maintenance is allocated second.

c. Allocate the costs of the two service departments to the two operating divisions using the step-down allocation method where Janitorial/Maintenance is allocated first and Human Resources is allocated second.

d. Compute the Human Resource Department cost per employee under the three allocation methods (direct allocation, step-down allocations where Human Resources is first, and the step-down method where Janitorial/Maintenance is first).

e. Compute the Janitorial/Maintenance cost per square foot under the three allocation methods (direct allocation, step-down allocations where Human Resources is first, and the step-down method where Janitorial/Maintenance is first).

f. Briefly discuss the various factors IFLAX management should consider in choosing how to allocate the two service department costs to the two operating divisions.

Correct Answer:

Verified

a. Direct allocation method:

c. Step-...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

c. Step-...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Somimad Sawmill manufactures two lumber products from

Q6: When considering the purchase of a

Q7: Williams manufactures a variety of iron

Q8: At the Hilton Apple Fest and

Q9: Each week Walters Company produces 15,000

Q11: Williams manufactures a variety of iron

Q12: Internal resources, such as the legal department,

Q13: An insurance company has the following

Q14: Cosmo Inc. operates two retail novelty

Q15: Which is not true of the various