Multiple Choice

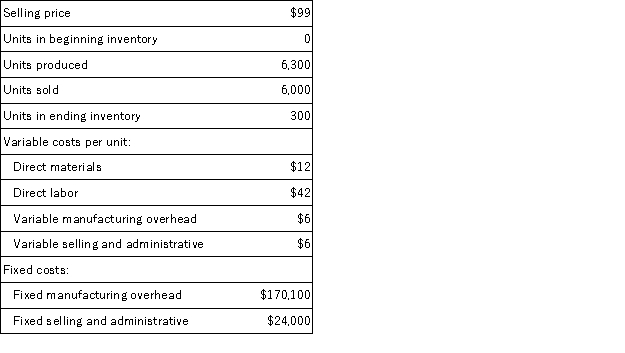

Aaker Corporation,which has only one product,has provided the following data concerning its most recent month of operations:  The total gross margin for the month under the absorption costing approach is:

The total gross margin for the month under the absorption costing approach is:

A) $98,100

B) $198,000

C) $72,000

D) $12,000

Correct Answer:

Verified

Correct Answer:

Verified

Q68: The costs assigned to units in inventory

Q85: A company that produces a single product

Q164: Under conventional absorption costing, the fixed costs

Q171: Crossbow Corp.produces a single product.Data concerning June's

Q174: O'Neill,Incorporated's segmented income statement for the most

Q176: Farron Corporation,which has only one product,has provided

Q177: O'Neill,Incorporated's segmented income statement for the most

Q178: Harris Corporation produces a single product.Last year,Harris

Q221: A company produces a single product. Variable

Q228: Under absorption costing, fixed manufacturing overhead is