Multiple Choice

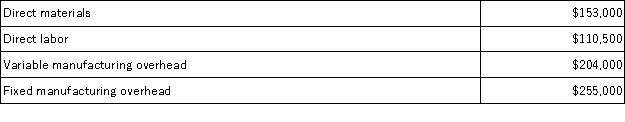

Harris Corporation produces a single product.Last year,Harris manufactured 17,000 units and sold 13,000 units.Production costs for the year were as follows:  Sales were $780,000 for the year,variable selling and administrative expenses were $88,400,and fixed selling and administrative expenses were $170,000.There was no beginning inventory.Assume that direct labor is a variable cost. Under absorption costing,the ending inventory for the year would be valued at:

Sales were $780,000 for the year,variable selling and administrative expenses were $88,400,and fixed selling and administrative expenses were $170,000.There was no beginning inventory.Assume that direct labor is a variable cost. Under absorption costing,the ending inventory for the year would be valued at:

A) $190,800

B) $170,000

C) $230,800

D) $0

Correct Answer:

Verified

Correct Answer:

Verified

Q68: The costs assigned to units in inventory

Q75: When using data from a segmented income

Q100: Cervetti Corporation has two major business segments-East

Q173: Aaker Corporation,which has only one product,has provided

Q174: O'Neill,Incorporated's segmented income statement for the most

Q176: Farron Corporation,which has only one product,has provided

Q177: O'Neill,Incorporated's segmented income statement for the most

Q180: Minick Corporation has two divisions: Grocery Division

Q181: Johnston Corporation manufactures a single product that

Q182: Elliot Corporation,which has only one product,has provided