Multiple Choice

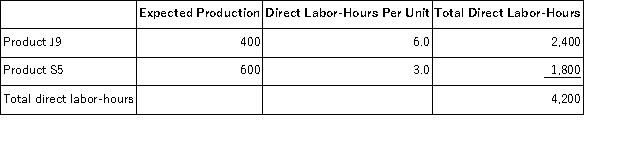

Accurso,Inc. ,manufactures and sells two products: Product J9 and Product S5.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $22.50 per DLH.The direct materials cost per unit for each product is given below:

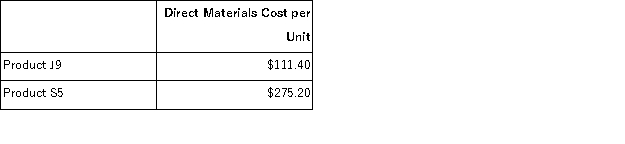

The direct labor rate is $22.50 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

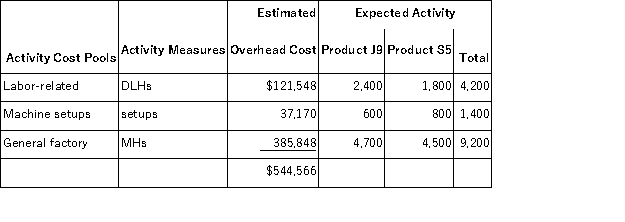

The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the overhead assigned to each unit of Product J9 would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method,the overhead assigned to each unit of Product J9 would be closest to:

A) $173.64 per unit

B) $251.64 per unit

C) $777.96 per unit

D) $159.30 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q119: Betenbaugh,Inc. ,manufactures and sells two products: Product

Q120: Angara Corporation uses activity-based costing to determine

Q121: Activity rates from Lippard Corporation's activity-based costing

Q122: Wlodarczyk,Inc. ,manufactures and sells two products: Product

Q125: Frogge,Inc. ,manufactures and sells two products: Product

Q126: Fullard,Inc. ,manufactures and sells two products: Product

Q127: Sylvest,Inc. ,manufactures and sells two products: Product

Q128: Diemer,Inc. ,manufactures and sells two products: Product

Q129: Villeda Corporation uses the following activity rates

Q201: Activity-based costing involves a two-stage allocation process