Multiple Choice

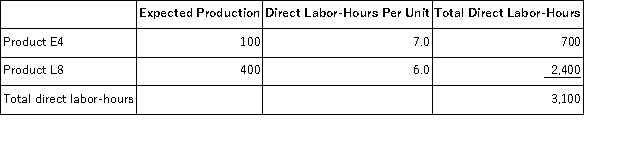

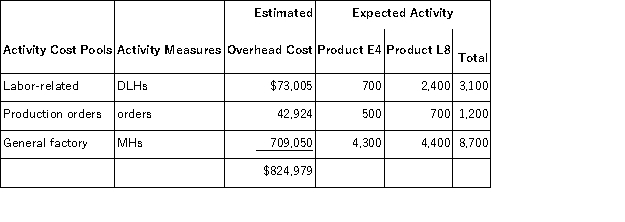

Betenbaugh,Inc. ,manufactures and sells two products: Product E4 and Product L8.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $29.00 per DLH.The direct materials cost per unit is $223.90 for Product E4 and $122.30 for Product L8. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The direct labor rate is $29.00 per DLH.The direct materials cost per unit is $223.90 for Product E4 and $122.30 for Product L8. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  The overhead applied to each unit of Product L8 under activity-based costing is closest to:

The overhead applied to each unit of Product L8 under activity-based costing is closest to:

A) $1,649.96 per unit

B) $1,100.40 per unit

C) $1,596.72 per unit

D) $896.50 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q114: Shadow,Inc. ,manufactures and sells two products: Product

Q115: Bohringer,Inc. ,manufactures and sells two products: Product

Q116: Machuga,Inc. ,manufactures and sells two products: Product

Q118: Brenneis,Inc. ,manufactures and sells two products: Product

Q120: Angara Corporation uses activity-based costing to determine

Q121: Activity rates from Lippard Corporation's activity-based costing

Q122: Wlodarczyk,Inc. ,manufactures and sells two products: Product

Q124: Accurso,Inc. ,manufactures and sells two products: Product

Q179: In activity-based costing, unit product costs computed

Q201: Activity-based costing involves a two-stage allocation process