Multiple Choice

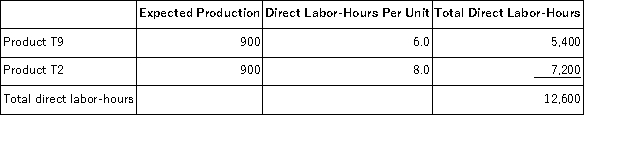

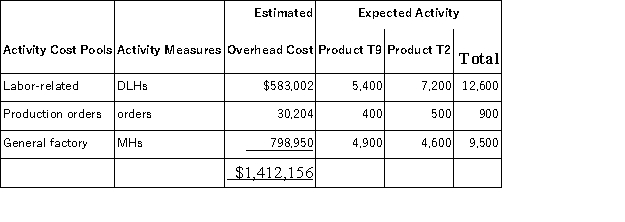

Brenneis,Inc. ,manufactures and sells two products: Product T9 and Product T2.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $18.10 per DLH.The direct materials cost per unit is $115.20 for Product T9 and $221.40 for Product T2. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:

The direct labor rate is $18.10 per DLH.The direct materials cost per unit is $115.20 for Product T9 and $221.40 for Product T2. The company is considering adopting an activity-based costing system with the following activity cost pools,activity measures,and expected activity:  Which of the following statements concerning the unit product cost of Product T9 is true?

Which of the following statements concerning the unit product cost of Product T9 is true?

A) The unit product cost of Product T9 under traditional costing is greater than its unit product under activity-based costing by $77.93.

B) The unit product cost of Product T9 under traditional costing is less than its unit product cost under activity-based costing by $77.93.

C) The unit product cost of Product T9 under traditional costing is greater than its unit product under activity-based costing by $224.16.

D) The unit product cost of Product T9 under traditional costing is less than its unit product cost under activity-based costing by $224.16.

Correct Answer:

Verified

Correct Answer:

Verified

Q113: Masiclat,Inc. ,manufactures and sells two products: Product

Q114: Shadow,Inc. ,manufactures and sells two products: Product

Q115: Bohringer,Inc. ,manufactures and sells two products: Product

Q116: Machuga,Inc. ,manufactures and sells two products: Product

Q119: Betenbaugh,Inc. ,manufactures and sells two products: Product

Q120: Angara Corporation uses activity-based costing to determine

Q121: Activity rates from Lippard Corporation's activity-based costing

Q122: Wlodarczyk,Inc. ,manufactures and sells two products: Product

Q179: In activity-based costing, unit product costs computed

Q201: Activity-based costing involves a two-stage allocation process