Multiple Choice

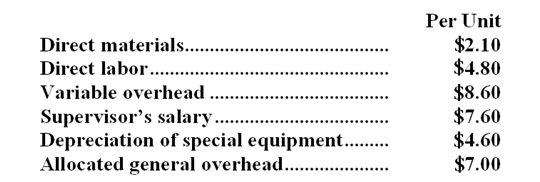

Meltzer Corporation is presently making part O13 that is used in one of its products. A total of 3,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to produce and sell the part to the company for $27.00 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $3,000 of these allocated general overhead costs would be avoided.

An outside supplier has offered to produce and sell the part to the company for $27.00 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $3,000 of these allocated general overhead costs would be avoided.

-If management decides to buy part O13 from the outside supplier rather than to continue making the part,what would be the annual impact on the company's overall net operating income?

A) Net operating income would decline by $23,100 per year.

B) Net operating income would decline by $26,100 per year.

C) Net operating income would decline by $20,100 per year.

D) Net operating income would decline by $8,700 per year.

Correct Answer:

Verified

Correct Answer:

Verified

Q102: Austin Wool Products purchases raw wool and

Q103: Mckerchie Inc. manufactures industrial components. One of

Q104: Ahsan Company makes 60,000 units per year

Q105: The Varone Company makes a single product

Q106: The constraint at Vrana Inc.is an expensive

Q108: Vertical integration is the involvement by a

Q109: When there is a production constraint,a company

Q110: Elhard Company produces a single product. The

Q111: Cung Inc.has some material that originally cost

Q112: Power Systems Inc.manufactures jet engines for the