Multiple Choice

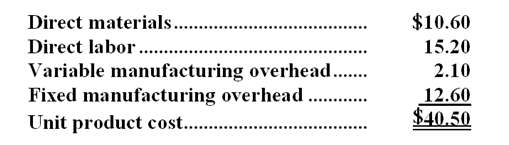

Ahsan Company makes 60,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows:  An outside supplier has offered to sell the company all of these parts it needs for $45.70 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $318,000 per year.

An outside supplier has offered to sell the company all of these parts it needs for $45.70 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $318,000 per year.

If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $3.50 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.

-What is the net total dollar advantage (disadvantage) of purchasing the part rather than making it?

A) $318,000

B) $(522,000)

C) $(312,000)

D) $(204,000)

Correct Answer:

Verified

Correct Answer:

Verified

Q99: Resendes Refiners, Inc., processes sugar cane that

Q100: Masse Corporation uses part G18 in one

Q102: Austin Wool Products purchases raw wool and

Q103: Mckerchie Inc. manufactures industrial components. One of

Q105: Cranston Corporation makes four products in a

Q105: The Varone Company makes a single product

Q106: The constraint at Vrana Inc.is an expensive

Q107: Meltzer Corporation is presently making part O13

Q108: Vertical integration is the involvement by a

Q109: When there is a production constraint,a company