Multiple Choice

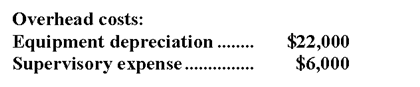

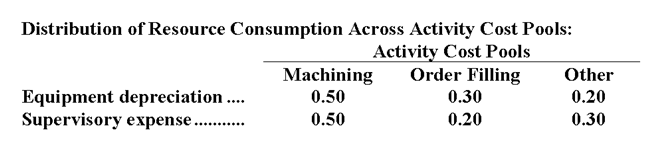

Brisky Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts-equipment depreciation and supervisory expense-to three activity cost pools-Machining, Order Filling, and Other-based on resource consumption. Data to perform these allocations appear below:

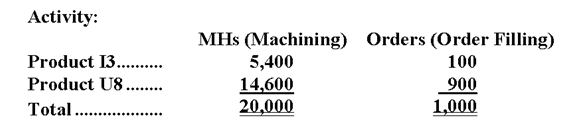

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.

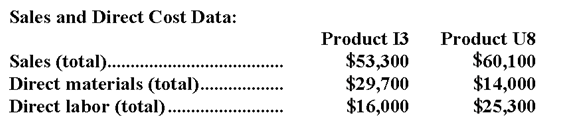

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.  Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

-What is the overhead cost assigned to Product I3 under activity-based costing?

A) $3,780

B) $14,000

C) $4,560

D) $780

Correct Answer:

Verified

Correct Answer:

Verified

Q121: Loffredo Corporation has provided the following data

Q122: Alongi Corporation uses the following activity rates

Q123: Higbie Corporation uses an activity-based costing system

Q124: Spadaro Corporation has an activity-based costing system

Q125: McCaskey Corporation uses an activity-based costing system

Q127: Lehner Corporation has provided the following data

Q128: Encarnacion Corporation has an activity-based costing system

Q129: Unit-level activities are performed each time a

Q130: Roskam Housecleaning provides housecleaning services to its

Q131: Abraham Company uses activity-based costing. The company