Multiple Choice

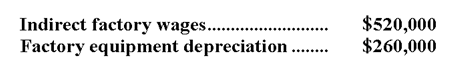

Lehner Corporation has provided the following data from its activity-based costing accounting system:  Distribution of Resource Consumption across Activity Cost Pools:

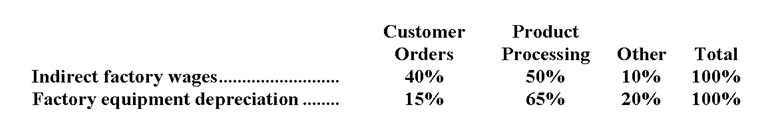

Distribution of Resource Consumption across Activity Cost Pools:

Activity Cost Pools  The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.

-How much indirect factory wages and factory equipment depreciation cost would be assigned to the Customer Orders activity cost pool?

A) $247,000

B) $390,000

C) $214,500

D) $780,000

Correct Answer:

Verified

Correct Answer:

Verified

Q122: Alongi Corporation uses the following activity rates

Q123: Higbie Corporation uses an activity-based costing system

Q124: Spadaro Corporation has an activity-based costing system

Q125: McCaskey Corporation uses an activity-based costing system

Q126: Brisky Corporation uses activity-based costing to compute

Q128: Encarnacion Corporation has an activity-based costing system

Q129: Unit-level activities are performed each time a

Q130: Roskam Housecleaning provides housecleaning services to its

Q131: Abraham Company uses activity-based costing. The company

Q132: Murri Corporation has an activity-based costing system