Essay

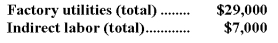

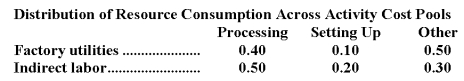

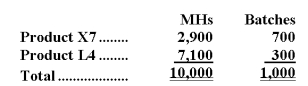

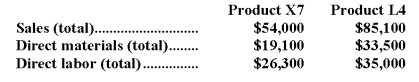

Murri Corporation has an activity-based costing system with three activity cost pools-Processing,Setting Up,and Other.The company's overhead costs,which consist of factory utilities and indirect labor,are allocated to the cost pools in proportion to the activity cost pools' consumption of resources.Costs in the Processing cost pool are assigned to products based on machine-hours (MHs)and costs in the Setting Up cost pool are assigned to products based on the number of batches.Costs in the Other cost pool are not assigned to products.Data concerning the two products and the company's costs and activity-based costing system appear below:

Required:

a.Assign overhead costs to activity cost pools using activity-based costing.

b.Calculate activity rates for each activity cost pool using activity-based costing.

c.Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

d.Determine the product margins for each product using activity-based costing.

Correct Answer:

Verified

a.Assign overhead costs to activity cost...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q127: Lehner Corporation has provided the following data

Q128: Encarnacion Corporation has an activity-based costing system

Q129: Unit-level activities are performed each time a

Q130: Roskam Housecleaning provides housecleaning services to its

Q131: Abraham Company uses activity-based costing. The company

Q133: Hugle Corporation's activity-based costing system has three

Q134: Reach Consulting Corporation has its headquarters in

Q135: The controller of Ferrence Company estimates the

Q136: Cosgrove Company manufactures two products,Product K-7 and

Q137: Encarnacion Corporation has an activity-based costing system