Multiple Choice

A portfolio's annual total returns (in percent) for a 5-year period are:  The median and the standard deviation for this sample are closest to:

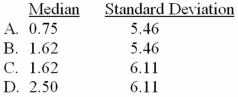

The median and the standard deviation for this sample are closest to:

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q64: As of September 30,2011,the earnings per share,EPS,of

Q65: The following table shows the annual returns

Q66: The following frequency distribution represents the number

Q68: The following data is a list of

Q70: The following frequency distribution represents the number

Q71: The following is data a veterinarian collected

Q73: The MAD is a less effective measure

Q74: For k > 1, Chebyshev's theorem is

Q74: How do you define the range?<br>A)Q3 -

Q104: What does the covariance measure?<br>A) The direction