Multiple Choice

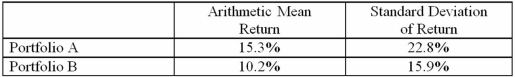

The table below gives statistics relating to a hypothetical 10-year record of two portfolios.Assume other statistics relating to these portfolios are the same and the risk-free rate is 3.5%.Using the coefficient of variation and the Sharpe ratio,the fund that is preferred in terms of relative risk and return per unit of risk is

A) Portfolio A since it has a higher coefficient of variation and a lower Sharpe ratio.

B) Portfolio A since it has a lower coefficient of variation and a higher Sharpe ratio.

C) Portfolio B since it has a higher coefficient of variation and a lower Sharpe ratio.

D) Portfolio B since it has a lower coefficient of variation and a higher Sharper ratio.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Janice Anooshian asks eight of her friends

Q3: Consider a population with data values of

Q3: Calculate the mean,median,and mode of the sample

Q5: Automobiles traveling on a road with a

Q6: The following is a list of the

Q7: In what way(s)is the concept of geometric

Q8: When using the empirical rule,which assumption is

Q9: The mode is defined as…<br>A)The middle point

Q10: The mean return on equity (ROE)for a

Q11: Three investment options are under consideration for