Declining Balance Depreciation On July 6,2014,Grayson Purchased New Machinery with an Estimated Useful

Essay

Declining balance depreciation

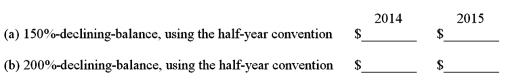

On July 6,2014,Grayson purchased new machinery with an estimated useful life of 10 years.The cost of the equipment was $80,000,with a residual value of $8,000.

Compute the depreciation on this machinery in 2014 and 2015 using each of the following methods.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: The fair market value of Lewis Company's

Q44: The book value of equipment:<br>A)Increases with the

Q62: Maintenance and fuel costs are types of

Q73: The application of the matching principle to

Q76: The book value of an asset in

Q98: If an accelerated depreciation method is used

Q98: All of the following may be considered

Q101: Depreciation; gains and losses in financial statements<br>In

Q106: On March 2,2014,Glen Industries purchased a fleet

Q107: Land and a warehouse were acquired for