Essay

Depreciation; gains and losses in financial statements

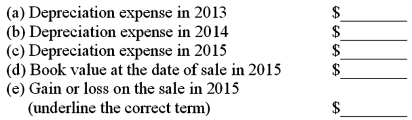

In 2013,Amalfi,Inc.purchased equipment with an estimated 10-year life for $42,600.The residual value was estimated at $9,900.Amalfi uses straight-line depreciation and applies the half-year convention.

On April 18,2015,Amalfi closed one of its plants and sold this equipment for $33,600.Under these assumptions,compute the following for this equipment:

Correct Answer:

Verified

Correct Answer:

Verified

Q5: The fair market value of Lewis Company's

Q44: The book value of equipment:<br>A)Increases with the

Q62: Maintenance and fuel costs are types of

Q73: The application of the matching principle to

Q98: If an accelerated depreciation method is used

Q98: All of the following may be considered

Q99: Book value represents the cost of an

Q103: Declining balance depreciation<br>On July 6,2014,Grayson purchased new

Q106: On March 2,2014,Glen Industries purchased a fleet

Q136: Under the half-year convention,six months' depreciation is