Essay

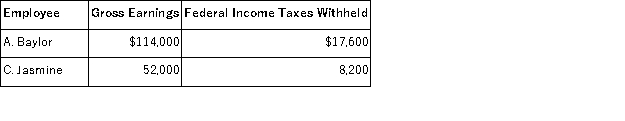

A company's employer payroll tax rates are 0.6% for federal unemployment taxes, 5.4% for state unemployment taxes, 6.2% for FICA social security taxes on earnings up to $118,500 per calendar year, and 1.45% for FICA Medicare taxes on all earnings. Compute the W-2 Wage and Tax Statement information required below for the following employees:

A.Baylor

C.Jasmine

W-2 Information:

________

________

Federal Income Tax Withheld

________

________

Wages, Tips, Other Compensation

________

________

Social Security Tax Withheld

________

________

Social Security Wages

________

________

Medicare Tax Withheld

________

________

Medicare Wages

________

________

Correct Answer:

Verified

A. Baylor

C. Jasmine

W-2 Information:

Fe...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

C. Jasmine

W-2 Information:

Fe...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Athena Company provides employee health insurance that

Q36: A _ shows the pay period dates,

Q44: Companies with many employees often use a

Q54: SaveMart had income before interest expense and

Q96: A contingent liability is:<br>A)Always of a specific

Q98: FICA taxes include:<br>A)Social Security and Medicare taxes.<br>B)Charitable

Q118: Employers must pay FICA taxes twice the

Q119: Deacon Company provides you with following information

Q142: A _ is a seller's obligation to

Q197: Obligations due within one year or the