Essay

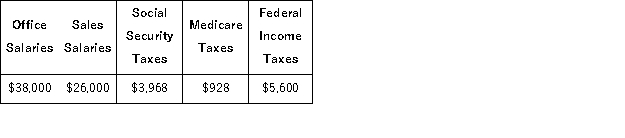

Deacon Company provides you with following information related to payroll transactions for the month of May. Prepare journal entries to record the transactions for May.  a. Record the May payroll using the payroll register information given above.

a. Record the May payroll using the payroll register information given above.

b. Record the employer's payroll taxes resulting from the May payroll. The company had a state unemployment tax rate of 3.5% of the first $7,000 paid each employee. Only $42,000 of the current months salaries are subject to unemployment taxes. The federal rate is 0.6%.

c. Issue a check to Reliant Bank in payment of the May FICA and employee taxes.

d. Issue a check to the state for the payment of the SUTA taxes for the month of May.

e. Issue a check to Reliant Bank for the first quarter in FUTA taxes in the amount of $1,020.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Athena Company provides employee health insurance that

Q36: A _ shows the pay period dates,

Q44: Companies with many employees often use a

Q96: A contingent liability is:<br>A)Always of a specific

Q98: FICA taxes include:<br>A)Social Security and Medicare taxes.<br>B)Charitable

Q118: Employers must pay FICA taxes twice the

Q120: A company's employer payroll tax rates are

Q142: A _ is a seller's obligation to

Q145: An employer has an employee benefit package

Q197: Obligations due within one year or the